Changes to Singapore Import Excise Tax will be effective from January 2023

In accordance with the above changes, shipments imported into Singapore on or after Jan 5, 2024 will be subject to an 9% Goods & Services Tax (GST).

For more details, please refer to the website of the Singapore Revenue Authority.

tenso.com will charge 9% GST for the following:

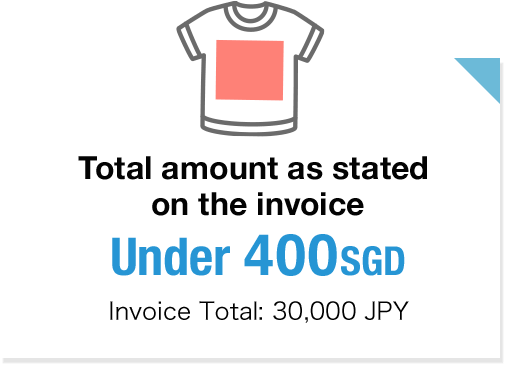

Furthermore, whether or not items exceed 400 SGD will be decided based on our foreign exchange conversion rate.

If you have settled invoice value's GST with tenso.com when arranging for shipment but is charged by the shipping company upon arrival again, please contact tenso.com's customer support along with the shipping company's payment receipt.

The GST only affects the import consumption tax. Import duties will not be changed.

The import duty will be charged by the shipping company upon delivery (if incurred).

* Please note that GST will not be collected in advance for shipments sent to Singapore by Japan Post by sea, but customs duties may be collected separately.

We apologize for any inconvenience these changes may cause you. Thank you for your understanding.